Circulus Agtech

Upcycling organic waste into precise, pathogen free liquid fertilizer.

Right from the start, Spring existed to change the world through innovation. We work with entrepreneurs, investors, partners and more to foster innovation with purpose by aligning methodologies, joining networks and offering needed resources to entrepreneurs solving the most pressing challenges for people and the planet.

“At Spring, how innovation comes alive for me is through our values, the ‘be entrepreneurial’ piece. At the start, all of us were entrepreneurs, and we definitely have a lot of people who have co-founded businesses, have side hustles. And so we really understand what it takes to set up a business, but also to be agile and and always be improving, always be testing, learning and iterating.

– Caroline von Hirschberg, Co-CEO

“I think about innovation at a couple of levels at Spring. One is at the entrepreneur investor level. Watching the entrepreneurs and how they are innovating to solve the world’s biggest problems, and how we support that. Part of that process is watching how people are employing new technologies in different ways to really scale impact, how that’s being supported financially by investors.

– Keith Ippel, Co-CEO

Here are just some of the fascinating companies we’ve supported over the years who continue inspiring us with their innovative solutions to big challenges:

Upcycling organic waste into precise, pathogen free liquid fertilizer.

Massive logistics and business model innovation to make upcycling possible.

Eco-friendly shower system that uses up to 80% less water and energy.

Improving economic opportunities & reducing the stigma for informal recyclable collectors.

AI empowered environmental, health and safety compliance. Acquired by Intelex.

North America’s first one way rideshare between cities.

Fundraising CRM uniting nonprofit & donor communications to improve donor relations.

Smart indoor air quality management to maintain filtration, ventilation and humidity control.

We acquired the Kick Incubator as part of a prolific programming phase, including diverse cohorts that supported over 240 entrepreneurs. Spring led the VanImpact Summit as part of the inaugural Vancouver Startup Week and did its first global work in the Western Balkans.

Total Founder program alumni

Entrepreneurs impacted

Average per year

Supported in 2014-2021

Supported in 2022

Supported in 2023

Female founders

BIPOC founders

Immigrant founders

Female founders

BIPOC founders

Immigrant founders

We got certified as a B Corp to take a huge step forward in measuring our impact and being accountable. We created roundtables with curated groups of entrepreneurs meeting on a regular basis for ongoing support, problem solving and leadership development. We also expanded our global work to include Latin America and hosted over 400 people at the second annual VanImpact Summit.

We can’t change the inequities in who receives VC funding without first expanding the definition of who can be an investor while redefining the metrics of a successful investment. When we diversify who is coming to the table with money, along with their range of priorities, we’re simultaneously diversifying the types of solutions being funded.

Over our 10 years, we have developed a robust structure that creates space for anyone and everyone to learn how to become an impact investor. By integrating our programming and networks with Future Capital, we now offer opportunities for every level of experience. Whether you’re just curious and checking it out, participating as a non-accredited investor or newly accredited investor, or a seasoned long term investor looking to add impact to your portfolio, we have the courses, challenges, communities and capital funds you need. THIS is how we shift the investment ecosystem to solve the critical issues being reimagined by a diverse range of founders.

Throughout our journey, what was very interesting is that at the end of the first year, a lot of entrepreneurs were like, can you help us raise money? Can you help us to finish our round? And so it was quite interesting, because we actually very reluctantly got into that space. And, and as we started to get into it, that’s actually how that side of the business really started to blossom, because we did see that there was a clear need, like a real need. And also there was a way for us to add value and to be supportive.

We first started to do our work with impact investors back in late 2018. And as soon as we started to do that, we saw the demand for it. And we saw people who were hungry to invest, repurpose. And so that’s when we added investor events. We added our first Impact Investor Challenge. And that’s really helped build out that entire side of the Spring business that has since then included the launch of the Spring Collective and also the launch of the Spring Impact Capital Fund.

–Keith Ippel, Co-CEO

Female investors

BIPOC investors

Non-accredited investors

Female investors

BIPOC investors

Non-accredited investors

Our Impact Investor Challenge launched in 2019, with Open Ocean Robotics taking home the first ever IIC investment of over $100,000. We also hosted our first autism incubator program, did global work in Lima, Balkans, Serbia, Vietnam and worked with the Vancouver Economic Commission on capital training and investment readiness programming.

We really believe that if we’re helping impact entrepreneurs and impact investors, we have to walk the talk, we have to show people that an organization can be a vibrant impact organization and make money.

Proving the model is really important, and I think now we have acted as that role model for others who can step into it as well.

–Keith Ippel, Co-CEO

Spring wouldn’t be true to itself if our vision was for a world where every business is an impact business and every investor is an impact investor, but we ourselves weren’t also an impact business with investors. That’s why Spring has always been a for profit entity.

In 2016, two years into our operations, we made a decision to raise an investment round. We did it both to fuel the growth of Spring, but even more importantly to create a template in the market for how an investment could be done in an impact organization that was not designed to go venture scale.

We set it up as a redeemable share structure, which is a form of revenue-backed capital. Our investors put their investments in a special class of shares that was then repurchased by the company over time through a percentage of revenue. In Spring’s case, we chose to offer 3X total return with no time limit for repayment, which would allow the company to grow in the way that needed to from a timeline perspective. This would also provide not only an acceptable rate of return for the investors but also demonstrate how a good rate of return could be achieved by an impact venture.

When we first took on the investment, Spring had a team of just 4 people and we were only working in the Vancouver ecosystem. In June 2023, seven years later, we did a full redemption of those shares at that 3X return for those investors. This investment and time enabled us to build a team of 35, support over 2,000 founders, work in more than 60 communities in Canada & globally, launch the Spring Collective national impact investor network and launch our VC fund, Spring Impact Capital.

This investment was not just an opportunity to fuel the growth of Spring, but also to have a group of incredible impact investors come alongside us to provide them with a great return while also knowing their investment was scaling impact. Massive impact was created by this investment using this creative structure and we’re proud to share about it in hopes that more companies and investors will be able to create their own impactful structures.

We were the first in Canada to focus on global impact businesses looking to move to Canada and making the world a better place through their ventures. We expanded our roundtable offering, running 14 of them and supporting 130+ impact founders and leaders.

We started providing deeper advisory and consulting support, completing projects in the Balkans, Zurich, Vietnam, Peru, Nicaragua and parts of South-East Asia. 2018 ended with our first Impact Investing social, hosting 100 investors in Vancouver and validating the interest in impact investing.

Our Impact Startup Visa program launched in 2017 with our first cohort of international entrepreneurs. It’s designed to help founders from around the world bring their purpose-driven company to Canada. We provide participants with business training and guidance, as well as connecting them to a supportive community to welcome them to their new home.

There have been 18 more cohorts since the program launched, as we continue increasing the number of sessions each year. We’ve also added a Premium program for those who want an increased level of services and support as they make the bold transition to moving themselves, their family and their business across the world.

Of course, once they’re here, they have access to the full scope of Spring programs, events and connections they need to grow their impact business in a new market. It means so much to us to be able to help these newcomers as they bring their dynamic companies into the Canadian economy, making a positive difference for people and the planet.

It always amazes me how many countries these immigrant entrepreneurs are coming from, and the ways in which we can support them, because often they’re representing very different industries, different business models. But at the core, what keeps us all together is the fact that all of us are building a business that has a sustainable impact for people or the planet. It’s just such a pleasure to be part of that journey, making the bold decision to move to Canada and seeing how we can support them.

–Caroline von Hirschberg, Co-CEO

Cohorts since 2017

ISV Alumni in total

Countries of origin (ISV Alumni + team members)

Responding to the chaos and uncertainty of THAT year, we developed the Business Resilience Program to provide partner-funded and independent support to small businesses as a result of needs arising due to COVID-19. This online learning platform engaged 270 communities across 55 countries. We also ran our first online Impact Investor Challenge, with Indiegraf taking home the investment prize.

“You can’t have impact without DEI. They are intrinsically linked. And so it is, from my perspective, not only an economic imperative, it’s a moral imperative … if we want to change the world, the only way that we can do that is bring a diversity of voices, a diversity of education, a diversity of upbringing, backgrounds. Every aspect of life can breed diversity, and we need to embrace that fully, both as entrepreneurs and as investors to actually change the world. And so for me, it is that there is no there is no impact without DEI period.”

-Keith Ippel, Co-CEO

“It’s such a no brainer. For me, building more diverse teams, building a more diverse and inclusive investor ecosystem is essential to achieving a positive social and environmental impact.”

-Caroline von Hirschberg, Co-CEO

It’s easy to look at the stats on investment in women-led companies and get completely discouraged. Only 2.4% of VC funding went to women founders in 2021 and that painfully small number actually decreased to just 1.9% in 2022. The situation is even worse for BIPOC women who make up a disproportionately low fraction of those stats.

Instead of getting caught up in blame and disillusionment, Spring took action: we developed a national, action-oriented plan to improve investment in women and non-binary led companies. How? By training founders on investment readiness, while simultaneously training investors in impacting investing. After a highly successful 2022 Impact Investor Challenge won by game-changer VoxCell BioInnovation, we secured multi-year government funding from both the Women Entrepreneurship Strategy and the National Research Council of Canada Industrial Research Assistance Program (NRC IRAP) to make the initiative a multi-year reality.

This past fall, the 2023 Women-Led Impact Investor Challenge convened a pool of new and experienced impact investors alongside 15 women-led, purpose-driven companies. The winner, Lite-1, raised $120K from the investor cohort and (pending DD) will receive a matching investment from BDC Thrive Lab in 2024.

Our commitment to diversity, equity, inclusion & belonging extends beyond one program. Our “You Belong” core value represents our active commitment to making everyone feel welcome, included and supported. This is embodied by our team and embedded in our programming, activities and purpose. We’re championing Equity Squared, giving both forms of equity – traditional financial equity and social equity – a role in providing underrepresented founders and investors with the specific support they need.

Female founders

BIPOC founders

Immigrant founders

Female founders

BIPOC founders

Immigrant founders

In 2023, Spring acquired Future Capital, the learning and investing platform built for underrepresented early-stage investors. With an impressive reputation for delivering high impact investor training, Future Capital has truly made a difference. Announced September 2023, the acquisition was a refreshing, good news story in a daunting financial landscape. The best part? Future Capital’s Founder & CEO, Marlon Thompson, joined Spring’s Executive Team as our Chief Experience Officer (CXO).

“Future Capital was born out of my own personal experience being someone in the venture capital space that is fairly underrepresented. So I think diversity, equity & inclusion was always at the center of everything that we did, and really creating a more diverse cohort of investors and really supporting a broader swath of the economy through more inclusive investment decisions. That was really the purpose of the work that we did and how it actually showed up was through capacity building, training and development, and really kind of giving folks the skills and the tools and the language required to participate in this asset class.

I think the acquisition of Future Capital is prioritizing underrepresented communities full stop. For me personally, I definitely always feel like I have a voice and a seat at the table. I think there’s a lot of trust in my vision and the vision that we have been executing on at Future Capital … the acquisition has allowed us to do more. And so when we do more, there’s more economic inclusion, because that is our sole purpose. I think the merging of minds, initiatives, programs and people has just allowed us to deepen our work.”

– Marlon Thompson, CXO

Program Cohorts

Participants in total

Women + Non-Binary participants

We focused our activities into Entrepreneur, Investor & Ecosystem streams, expanded our Impact Startup Visa program to 2 cohorts a year and our team headcount jumped from 8 to 20, with the remote work landscape enabling us to add talent from Toronto and Oakland. We expanded our Impact Investor Challenge regionally and nationally, celebrating the fact that all 5 IIC winners to date were women-led companies. We also launched our first food incubation program for Black women entrepreneurs.

It was a big year for impact investing as we catalyzed over $17M in investment for companies in our Impact Investor Challenges. Across all of our programs we helped 571 entrepreneurs and trained 116 impact investors. In November, we launched the Collective, Spring’s impact investing network. We also expanded our immigrant entrepreneur work with the addition of an incubator stage program and our first Premium version of the Impact Startup Visa program.

B Corporations (B Corps) are a type of for-profit businesses that prioritize social and environmental responsibility alongside financial success.

Certified by the nonprofit organization B Lab, B Corps voluntarily meet rigorous standards of social and environmental performance, accountability, and transparency. These companies commit to using their business as a force for good, considering the impact of their decisions on various stakeholders, including employees, customers, communities and the environment. B Corps represent a growing global movement of businesses that aim to balance purpose and profit to create a more sustainable and inclusive economy.

Spring’s registration as a B Corp underscores its commitment to ethical business practices and positive contributions to society.

We became a B Corp in 2017. Being a B Corp isn’t a one-and-done process. We recertified in 2021, and will do so every 3 years, with our next recertification ahead in 2024.

The minimum qualification is 80% and we’re proud to have originally scored 94% in 2017 and increased to 97.8% in 2021. FYI – the median score for traditional businesses is 50.9%. Our commitment to positive impact is reflected in our high scores across the key categories of Customers (18.4), Environment (9.6), Community (28.7), Workers (33.2) and Governance (7.7). These numbers underscore our dedication to measuring our ethical business practices, social responsibility, and environmental sustainability.

As part of our programs, when talking about impact measurement tools, we often talk about the B Impact Assessment and how it helps create the north star for organizations (especially when they are at a nascent stage- building their teams, impact statement etc). Witnessing the positive impact of B Corp certification, many of our alumni companies have either pursued certification or are contemplating it for the future, inspired by our journey and the tangible benefits it brings to both business and society.

Becoming a B Corp offers companies a credible way to align with social and environmental values while enhancing your reputation and attracting conscious consumers and investors. The certification process helps identify areas for improvement, fostering continuous growth and responsible practices. Companies that become B Corps also experience increased employee satisfaction and loyalty.

Embracing B Corp status not only positions a company as a leader in corporate responsibility but also provides a strategic edge in a business landscape where ethical choices are increasingly valued, contributing to a more sustainable and equitable economy.

Median B Corp score for traditional businesses

Minimum B Corp qualification score

Spring’s 2021 B Corp score

The United Nations Sustainable Development Goals (SDGs) are one of the many guideposts we use to focus and assess our activities. We are directly active on these SDGs:

– 4: Quality Education

– 5: Gender Equality

– 8: Decent Work & Economic Growth

– 10: Reduced Inequalities

– 17: Partnerships for the Goals

Our work also fosters the enhancement of tech capability & progress while supporting the impact ecosystem to increase and strengthen their capacity and knowledge, connecting us to SDGs 9-12.

One of the best parts of working with such a compassionate, progressive and innovative community of founders and investors is that by supporting and empowering them, we are contributing to all 17 of the SDGs our world needs to improve and thrive.

1% for the Planet is an international organization founded on the idea that a company has a responsibility to give back for use of our planet’s resources.

It does this through certifying members who contribute a minimum of 1% of their revenue to environmental partners to tackle climate change, pollution, deforestation and more. This commitment can also include volunteer hours and marketing support for environmental partners.

We’ve been a member since 2019, recertifying each year.

We are consistently working to ensure we ’walk the talk’ and can be both a test best and demonstration of how purpose and profit can coexist and complement each other.

1% for the Planet’s model inspired us as a way to support causes we care deeply about in an accountable and transparent way.

Since 2019, our lifetime contribution to 1% for the Planet’s environmental partners is $87,685.

2019-2020

2020-21:

2021-2022

2022-2023

Taking Root (2019/20)

Canopy Planet (2021)

FoodStash Foundation (2022 & 2023)

Impact

Not only is it an easy and transparent way to sync impactful giving with your business’ revenue growth, you are able to design a strategy that works for you, your impact thesis and business model. Deep or broad, international or hyper-local – there are so many ways in which you can bring 1% for the planet to life for your organisation.

Team & Community Engagement

There’s many ways you can design volunteer opportunities with environmental partners and a range of environmental partners to choose from, all around the world (and you can nominate organizations if they aren’t already on the list).

Accountability

Recertifying each year keeps participating in this effort top of mind and ensures that companies are showing up consistently for environmental partners that count on our support to do their powerful and necessary work.

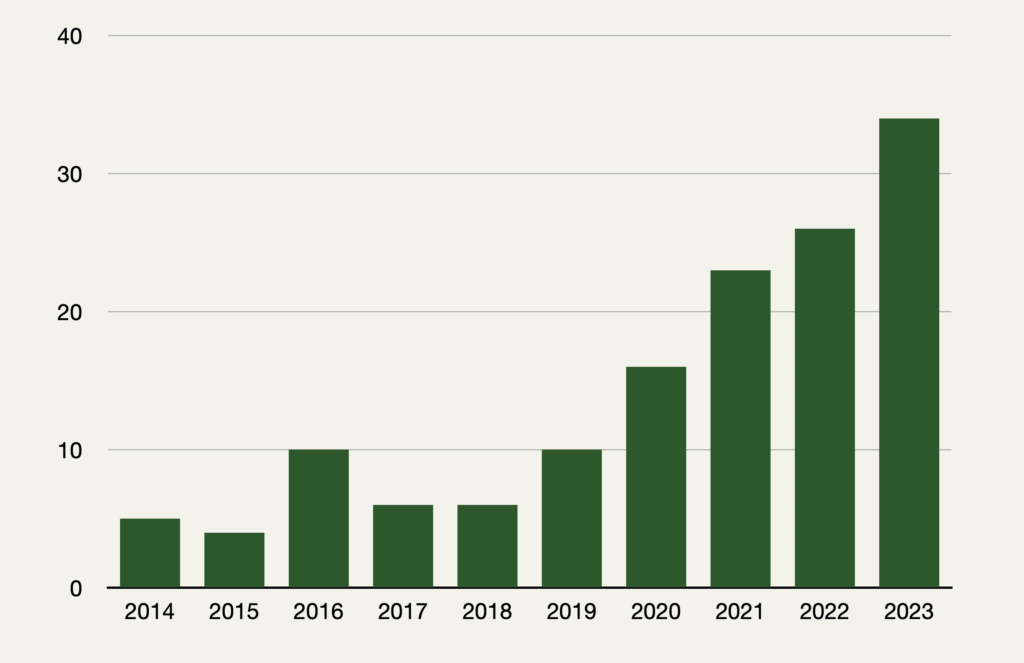

One clear indicator of Spring’s growgth over the last 10 years has been the increase in our number of team members. As we added new programs, expanded the volume of cohorts within programs and grew our impact, we needed even more fabulous people to bring the vision to life.

It definitely struck me when I joined Spring how diverse it was, in terms of the different nationalities we all have, the languages we speak and our views on the world. And I love that because it really does mean that we have rich conversations in terms of how do we support entrepreneurs better? How do we reach more diverse entrepreneurs?

–Caroline von Hirschberg, Co-CEO

Meet the spring Team

Our people ↗

Erin once won a rigged camel race in Australia and came in last in the unrigged final race.

Liv once snuck a pet snake on a plane in her sweater pocket after traveling with him for months doing science camps.

Standing tall at 5”4, Mari played competitive basketball in her teens hoping to eventually make the WNBA.

Davina worked in a social impact circus in Cambodia for 3 years, mostly dealing with investors but still, walking that “fine line”.

Selina grew up in a super-tiny town: Her high school had almost the same number of people as the town she lived in up until she was 8, and her university had more people than the second town she lived in up until she was 18.

Neema got invited to act with the Kenya National Theatre when only in high school.

Allison starred in the pilot series for a TV show called “Fit Kids” where she was forced to wear bad wigs while educating children on living a healthy lifestyle.

Olivia moved to Bangkok at 22 when she graduated university, knowing no one with barely a penny in her pocket. She taught English to preschoolers for a quarter before jetting off to travel SE Asia (mostly) solo for 5 months.

Heena once crossed a land border illegally and walked through a land mine region to visit a school in Burma.

Loreen competed in three 24-hour relay races in Hong Kong to raise funds and awareness to combat human trafficking in Southeast Asia.

Christine once drove a go-kart on the streets of (left-sided) Tokyo dressed as Toad from Super Mario.

Vanessa once took a stunt combat course led by one of the lead stunt coordinators on “The Revenant” (featuring Leonardo DiCaprio), learning the 8 ways to “fall” and how to “sell a fight scene” – she has the demo reel to prove it (hidden in a safe place never to be found)

Adaeze used to plan and manage huge weddings and events in Lagos and other states back home in Nigeria (The number of guests ranged from 500 – 3000).

Dil has spent her initial career working as a journalist and has been published through multiple outlets including MorrocoWorldNews.com (an online web-zine) and Desi Today, (a print magazine).

Data accumulated by Kilimanjaro National Park indicates that less than 30% of people who attempt a five-day climb reach the top. Ashima summited Mt. Kilimanjaro in 5 days. 12 weeks earlier, she ran her first Kilimanjaro half-marathon.

Natalie was the first baby of the millennium in Bahrain (and was in the newspaper for it too).

Nina auditioned for Little Miss Philippines – one of the top children’s pageant shows in the Philippines in 2001 and made it past the preliminary rounds but didn’t move on to the finals.

Amidst his music days with blond hair and high-profile gigs with Lady Gaga, the Black Eyed Peas and earning a Grammy nomination, Zav’s been consistently championing social impact.

Fabiola used to play judo and got up to the brown belt (the belt before the black one).

Graham’s first job in impact investing was working for Prince Max von und zu Liechtenstein. Our annual retreats in the Alps involved post-work Schnapps tasting, high speed tobogganing and dangerous bar games like Hammerschlagen… all creating their own type of sketchy impact.

Tina was once sitting just a few tables away from David Bowie and Iman at a fancy venue in Monaco.

Caroline was once in a camping tent with world leaders ‘The Elders’ including Kofi Annan, Jimmy Carter and Mary Robinson.

Alumni in total (Entrepreneurs & Investors)

Entrepreneurs impacted in total

Impact Startup Visa alumni

Investor alumni from the Impact Investor Challenge

Unique investor alumni

Direct impact investment through the Impact Investor Challenge

Total Alumni (Entrepreneurs & Investors)

2014–June 2021: 2158

July 2021–Aug 2022: 641

Sept 2022–Aug 2023: 521

Total to date: 3320

Entrepreneurs impacted (incl. ISV, IIC, other programs)

2014–June 2021: 2097

July 2021–Aug 2022: 571

Sept 2022–Aug 2023: 436

Total to date: 3104

ISV cohorts (started in 2017)

2014–June 2021: 5

July 2021–Aug 2022: 6

Sept 2022–Aug 2023: 6

Total to date: 19

ISV Alumni

2014–June 2021: 76

July 2021–Aug 2022: 68

Sept 2022–Aug 2023: 96

Total to date: 240

IIC Cohorts (started in 2019)

2014–June 2021: 4

July 2021–Aug 2022: 3

Sept 2022–Aug 2023: 5

Total to date: 12

IIC Investor Alumni

2014–June 2021: 63

July 2021–Aug 2022: 74

Sept 2022–Aug 2023: 102

Total to date: 239

Unique Investor Alumni

2014–June 2021: 61

July 2021–Aug 2022: 70

Sept 2022–Aug 2023: 85

Total to date: 216

Direct impact investment through IICs

2014–June 2021: $398,500

July 2021–Aug 2022: $645,100

Sept 2022–Aug 2023: $773,500

Total to date: $1,817,100

Events in 2022–23: 19, with 690+ attendees

In 2022, we launched the Spring Collective, Canada’s only national network for impact investors. It’s a community where investors can connect, share knowledge and collaborate on investments together. The Collective is open to those new to investing or those who are more experienced and looking to scale up their impact-focused portfolio.

Overall, the Collective aims to grow the pool of capital available for early stage purpose-driven founders by providing members with the reliable, vetted deal flow investors need to engage with impactful entrepreneurial solutions. We will be announcing our first 2024 investment soon and can’t wait for you to know who it is (but we have to wait until the announcement, sorry).

Some of Spring Collective’s Investments

Investors from across Canada

Invested in 5 companies

Female investors

In 2023, we launched Spring Impact Capital, our impact-focused venture capital fund that seeks to achieve market rate returns with greater purpose and meaning. Creating this $20M fund has been a massive undertaking, so we were excited to announce the closing of our first round in November 2023. We believe there is a significant, and often overlooked, opportunity to generate attractive returns and positive change by investing in early-stage Canadian businesses.

With that in mind, Spring Impact Capital focuses on companies with values-driven, diverse leaders who are seeking to scale solutions where profitability aligns with positive results in human and/or planetary health. For example, many structural tailwinds are creating dynamic impact investment opportunities in climate and health. To get innovative Canadian companies the capital they need when they need it most, we aim to fill the gap in pre-seed and seed funding.

Spring Impact Capital is led by Managing Partners Graham Day, Olivia Hornby and Keith Ippel. The fund’s first investment will be announced in early 2024, with a second funding announcement hot on its heels soon afterward.

A lot of BIG, exciting changes in 2023 created positive ripples through the impact community. We launched a venture capital fund, Spring Impact Capital, focused on investing in diverse founders with startups focused on human and planetary health. And we even ended up on the front of the Globe and Mail’s business section with the news that we acquired Future Capital to deepen the interconnection between diversity, equity, inclusion & belonging and impact in investment. We also grew to 35 team members (aka “Springers”), all across the country from Halifax and Vancouver Island with hubs in Vancouver and Toronto.

If that weren’t enough, we rebranded to a new, dynamic brand that reflects our energy moving forward. This included dropping “Activator” in our day-to-day operations and stepping forward with a bold new wordmark that identifies who we are today and moving forward: Spring.

“I’m planning our future strategy for supporting women led entrepreneurs, and other team members are working on similar approaches thinking about how do we meaningfully support black founders and the challenges they face? A broader community of BIPOC founders. Also those who are in more rural and remote communities? It’s a living and breathing piece and definitely is not done. I don’t think we’ll ever be done on that front. There’s always more work to be doing. How else can we think about diversity?

Ultimately, it’s about growth, but growth, not just for growth’s sake, not just in pure volume terms, but also in the depth and in the ways in which we’ve been able to genuinely support companies to build sustainable foundations to grow. And as a result, to grow the impact. I’m looking forward to hearing all of the stories from the founders that we’re reaching right now and hearing how they have changed the world through their innovation.”

-Caroline von Hirschberg, Co-CEO

“I think in the next 10 years what we really want to see is impact at scale … We want to see a vibrant community of impact entrepreneurs and impact investors who are interconnected both locally and globally, to be able to achieve what they need to achieve either in scaling and impact venture or investing for impact. I think that’s really important. We want to see true equitable access. 10 years from now we want to see this notion of like a 50/50 split across the board, where it doesn’t matter how you’re cutting it, because we’ve created equitable access. That equitable access should reflect the population, it should reflect the community that we live in. and that we interact with. And I think that that’s a really, really big part of it.

And then the final piece of impact at scale is 10 years from now, we will see many impact ventures that have gone public, that are global leaders in their sector period, whether impact or not, but they are impact. They’re actively and intentionally making the world a better place every day. I think that is going to be a huge shift in not only the impact world, but it’s going to be a huge shift in the economy, and it’s going to be a huge shift in the communities.

-Keith Ippel, Co-CEO

“What I would love to see and the impact investing ecosystem is more people of colour and women in decision making positions. I would love to see … specific data that demonstrates meaningful progress around the types of founders that receive funding from venture capitalists … I would really love to see us rethink the prioritization of profit and not have it just be the only thing that matters for business. Thinking about the planet, people, sustainability. I think that would be really incredible to see more of that in 10 years.

I think one of the things that Keith and Caroline and myself have always been aligned on is normalizing impact investing, like normalizing purpose driven entrepreneurship. Kind of not even needing to call it impact, I guess, maybe in 10 years would be really cool, because it’s just a part of the way new products, new businesses, new founders are discovered and support it.

-Marlon Thompson, CXO

“I have gained so much and feel incredibly fortunate. How do you accumulate and then try and speak to 10 years of so many incredible gifts that I have received through this process? I have received so much more than I have given. Just thank you.”

-Keith Ippel, Co-CEO

“Without our community, we just wouldn’t be here. They’re so pivotal in everything we do, in the success of our work.”

-Caroline von Hirschberg, Co-CEO

“I am so grateful. I have incredible amounts of gratitude to everybody that has touched the community, touched the organization and the brand, our events, experiences, programs, like literally, everyone from a funder to a partner to a learner, to the person that helped us set up a camera for some content. Everybody that’s part of the thing that we’re doing. I just feel so grateful for every single one.”

– Marlon Thompson, CXO

Our community is Spring. It’s every single one of you reading this: entrepreneurs, investors, team members, ecosystem partners, funders, mentors and more. Within that, we’re deeply grateful to be welcoming the Future Capital community into Spring. Saying you’re going to “change the world” together can be idealistic, but we’re doing it because of all of you. We’ve demonstrated how much impact can grow and thrive in 10 years. Now, in our next 10 years of collaboration, let’s make it mainstream. We are changing the world.